Katalyst: Kyber Protocol Upgrade and 2020 Plans

UPDATE, March 2020: Read our new KyberDAO: Staking and Voting Overview

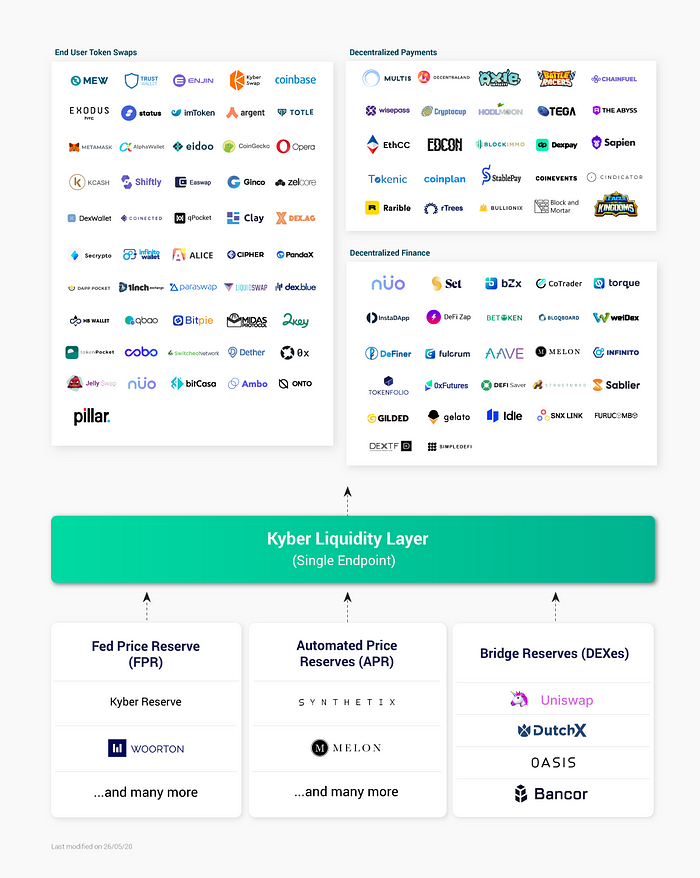

Kyber is an on-chain liquidity protocol that aggregates liquidity from a wide range of reserves, enabling instant and secure token exchange in any decentralized application.

Over the course of 2019, we have consolidated our position as the leading liquidity protocol for the decentralized ecosystem. Besides hitting the key milestones of over $400M and 2M ETH traded, and 500K on-chain trades (Dec 2019), we have built a solid ecosystem, with both the number of integrated DApps and Kyber-focused liquidity providers growing rapidly.

In 2020, we intend to follow up on our progress with 3 key areas of focus in order to further drive value for the decentralized ecosystem:

- Cementing Kyber’s position as the liquidity layer for DeFi by having the majority of takers and makers using Kyber as their single on-chain endpoint.

- Executing on Katalyst — a major protocol upgrade to encourage participation for key stakeholders in the Kyber ecosystem.

- Expanding value creation options for KNC (Kyber Network Crystal) holders, and putting them at the heart of Kyber’s governance through the KyberDAO.

1. Providing The Single Liquidity Endpoint For All Takers And Makers In DeFi

Since the beginning, Kyber has been built on 3 key concepts that the space has recently begun to appreciate: Fully on-chain token exchange (unlike off-chain or hybrid approaches), liquidity aggregation to get the best rates, and a standardized, convenient interface for liquidity providers so that they can easily contribute liquidity to our entire network.

Staying with these principles was a far harder path, but has paid off immensely for us as we are now the liquidity protocol with the highest number of integrations and a clear leader in the space. We formalized these ideas in the Kyber protocol paper, and further improved and updated our bridge reserves to ensure that takers will always get the best rates and spreads with Kyber.

Moving forward, we are focusing our efforts on becoming the liquidity layer of the DeFi space, with the aim of having the majority of DApp developers and liquidity providers using Kyber as their single on-chain endpoint.

To achieve this, we will need a strong and open ecosystem that the whole decentralized space can trust and work with to manage its liquidity needs, and one that any user, developer, or project can participate in if they are interested. That’s what we aim to achieve with the launch of Katalyst, Kyber’s protocol upgrade to further drive the creation of such an ecosystem.

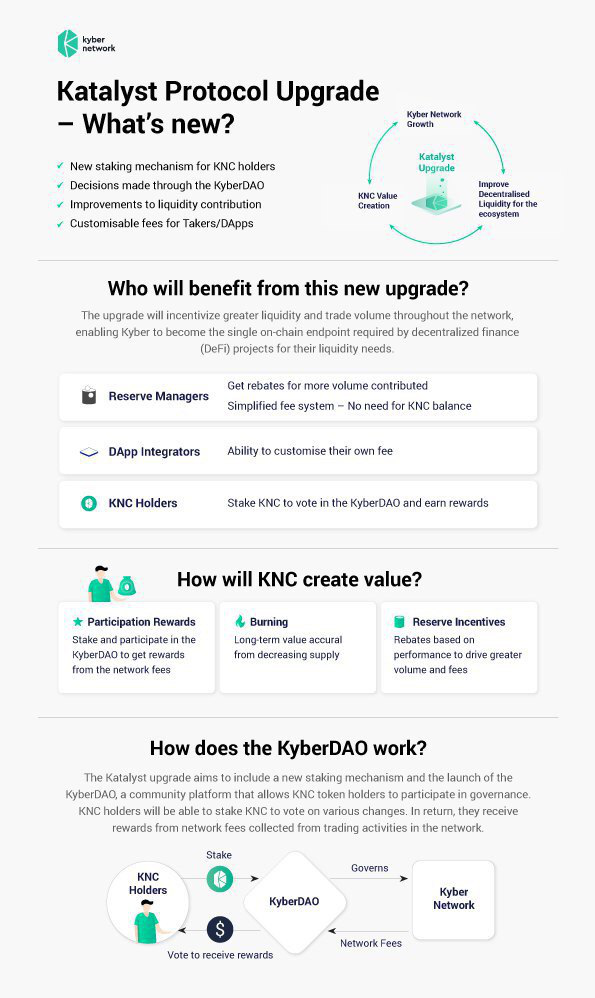

2. Katalyst: Major Protocol Upgrade To Drive Participation And Align Ecosystem Incentives

In every well-functioning ecosystem, there needs to be strong incentives for stakeholders to participate, as well as strong alignment towards a common end goal.

This Kyber protocol upgrade is meant for 3 key groups of Kyber stakeholders — Reserve managers who provide liquidity to Kyber, DApps who connect takers to Kyber’s protocol and of course, KNC holders who are at the heart of Kyber Network.

i: For KNC Holders

Staking and participation rewards: Kyber will introduce a new staking mechanism to the token model. This new model will allow KNC holders to receive part of the network fees by staking KNC and participating in the KyberDAO. More details will be shared in following posts.

KyberDAO to decide on key parameters: We will develop and launch the KyberDAO, giving the community of KNC holders the power to decide how the fees for the network (currently at 0.25% per trade, subject to change) will be used, by voting on the ratio / percentage between burning, staking rewards, and maker (reserve) incentives. In the future, the DAO will likely also be able to decide on listing tokens, reserve approvals, and network development grants. We expect key members of the DeFi ecosystem to actively participate in Kyber governance. Watch Katalyst EP1-KyberDAO staking and voting.

Read our KyberDAO: Staking and Voting Overview.

ii: For Reserve Managers

Reserve Incentives: Part of the total fees collected will now go towards incentivizing selected reserves based on how much trades and volume they facilitate for the network. This type of incentives, known as rebates in traditional finance, is a well-known and widely used mechanism to attract market makers. We expect this to incentivize more reserves creation and market making activity on Kyber, leading to much higher liquidity and broader reach.

Simplifying the fee system: Previously, one significant barrier to the creation and running of reserves was the need to maintain a KNC balance, which in turn will be collected regularly and burnt as network fees. Moving forward, reserves no longer need to maintain a KNC balance for fees. We intend to have the fees automatically collected in every trade and burnt or used for rewards and incentives, removing a major friction and pain point for reserves that want to integrate with Kyber. This does not affect the competitive rates that our takers are enjoying now. Watch Katalyst EP2 - Be a Kyber reserve.

iii: For DApp Integrators

Ability to set their own spread: It is critical for the evolution of the blockchain and DeFi space that DApp builders have the ability to decide their own business model. We are removing the previous fee-sharing program (30% of the 0.25% fee) and instead allow these developers to set their own custom spread. This will encourage many more DApp developers to build with Kyber, while at the same time giving them the ability to innovate on both business model options or target users with different needs. Watch Katalyst EP3 - Build with Kyber.

iv: For The Ecosystem

We believe these changes will significantly encourage participation and align incentives in the Kyber and DeFi ecosystem. DApp integrators and liquidity providers will have much stronger incentives and fewer barriers to focus on Kyber. KNC holders will benefit not just from the burning and rewards from the increased trade volume, but also by contributing to the many decisions needed for the long term growth of the network.

The above changes are slated to be completed in early Q2 next year. Before then, our main goal is to ensure that we have actively engaged all stakeholders to review the necessary tradeoffs for the first deployment of the Katalyst protocol upgrade.

3. Putting KNC Holders At The Heart Of Kyber

In the section above, we briefly explained how we intend to introduce staking and participation rewards for KNC holders, and for them to have decision-making power over fee usage through the KyberDAO.

The main motivation is to allow the token and its holders to play a critical role in determining the incentive system, building a wide base of stakeholders and facilitating economic flow in the network. We will now go into a deeper discussion on the benefits of this upgrade and the next steps:

i: New Value Creation Options For KNC Holders

In the past, burning (70% of the 0.25% network fee) was the only way for KNC holders to gain value from the growth that has happened in Kyber. While it was an excellent approach for long term value accrual, KNC holders now have additional options for value creation and can take on a more active role in the success of the network:

- Participation Rewards: Immediate value creation. Holders who stake and participate in the KyberDAO get their share of the fees designated for rewards. The more KNC staked, the bigger the share of fees.

- Burning: Long term value accrual. The decreasing supply of KNC will potentially improve the token appreciation over time, while also benefiting those who did not participate.

- Reserve Incentives: Value creation via network growth. By rewarding selected Kyber reserves based on their performance (i.e. amount of trade volume they facilitate), it helps to drive greater volume, value, and network fees.

ii: KNC Holders To Decide On Critical Protocol Parameters

Given that KNC hodlers should be the main beneficiary of increased activity and growth, it is imperative that they are in turn the ones who should determine the fees and the ratio of allocation. With the launch of the KyberDAO, every single KNC holder will become responsible for the critical task of determining the appropriate set of parameters for various scenarios that will best drive long term protocol growth and sustainability.

For example, setting a high fee, and having network fees all going to KNC holders will increase staking rewards but reduce competitiveness. Conversely, having no fees and rewards will lead to lower demand for KNC and lack of incentives for takers and makers. These are decisions that we will now make together as one KNC community.

iii: Expanding the KNC Community

It is critical to have as many people as possible from the Kyber and DeFi ecosystem become part of the KNC community. With the protocol update and new token model, reserves, DApps, and other key stakeholders in the Kyber and DeFi ecosystem will now have a clear reason to hold and support KNC. More importantly, they will be incentivized to support Kyber’s protocol, work to improve the system, as well as leverage Kyber more in their operations.

KNC holders who do not wish to participate in governance will still be able to earn rewards by delegating their tokens and voting power to staking platforms. Reputable platforms such as Trust Wallet, imToken, RockX Miner, and Hyperblocks have already expressed their support for KNC staking, and existing investors in Kyber Network, such as #Hashed and Signum Capital will also be participating in governance.

iv: Kyber’s Role

The Kyber team will play the role of facilitating discussions and take on the most technically demanding components. In particular, we will be working to vastly enhance operations, core governance processes, and a lot of education and training to improve community knowledge. This will support our ongoing efforts to onboard more liquidity providers, professional market makers, and DApps into the Kyber and DeFi ecosystem.

To make sure that the upcoming protocol changes are going to be the best possible initiative we can perform together as a community, we will actively discuss these topics with everyone in our social channels, and open a dedicated forum for KyberDAO and governance discussions. We look forward to engaging with all the stakeholders of the Kyber community and ecosystem to chart our future success together.

Kyber, Together

In this post, we have outlined our key goals of providing a single liquidity endpoint for the decentralized ecosystem, encouraging participation from makers, takers and the KNC community, and expanding mechanisms for value accrual for KNC. These upgrades will happen in phases and are expected to be completed by the end of Q1 or early Q2, 2020.

Together, these changes will harmonize our efforts towards providing a single on-chain liquidity endpoint for all takers and makers, and establish a long term virtuous loop where the success of the DeFi space, growth of the kyber ecosystem, and value creation for KNC holders go hand in hand.

We hope this post is a good summary of our intentions and approach. As we bid 2019 adieu and prepare to welcome 2020, we would like to warmly invite all our partners and KNC stakeholders to join us in building the next exciting version of Kyber and driving liquidity in the DeFi space together.

Read our KyberDAO: Staking and Voting Overview!

Watch our 2019 recap:

Videos about Katalyst

- Intro to Kyber Network: https://t.co/aT1ZfFWryM

- EP1-KyberDAO staking and voting: https://t.co/gBJ0BVapPt

- EP2-Be a Kyber reserve: https://t.co/34F4CROsqr

- EP3-Build with Kyber: https://t.co/N1js8uJDsE

For additional information, please contact Shane on Telegram https://t.me/shaneHk or Twitter https://twitter.com/shaneMkt

About Kyber Network

Kyber’s on-chain liquidity protocol allows decentralized token swaps to be integrated into any application, enabling value exchange to be performed seamlessly between all parties in the ecosystem. Using this protocol, developers can build innovative payment flows and applications, including instant token swap services, ERC20 payments, and financial DApps — helping to build a world where any token is usable anywhere.

Kyber is the most used and integrated decentralized finance (DeFi) protocol in the world, with over US$1Billion worth of transactions facilitated since its inception. Kyber supports over 80 different tokens, and powers over 100 integrated projects including popular wallets MEW, Trust, Enjin, Argent, and the HTC Exodus smartphone, as well as DeFi platforms Nuo, DeFiSaver, InstaDApp, Set Protocol, Melon, and many others.

Discord | Website | Blog | Twitter | Reddit | Facebook | Developer Portal | Kyber Tracker | KyberWidget Generator | Github